The Woodward Opera House’s restoration would not have been possible without the assistance of State and Federal historic tax credits. But what exactly is a tax credit? A tax credit is a dollar-for-dollar reduction in the amount of taxes owed. This means that the end cost of restoring the Woodward is greatly diminished as a result of receiving not one, but four different historic tax credits:

• Federal New Market Tax Credit

• State New Market Tax Credit

• Federal Historic Tax Credit

• State Historic Tax Credit

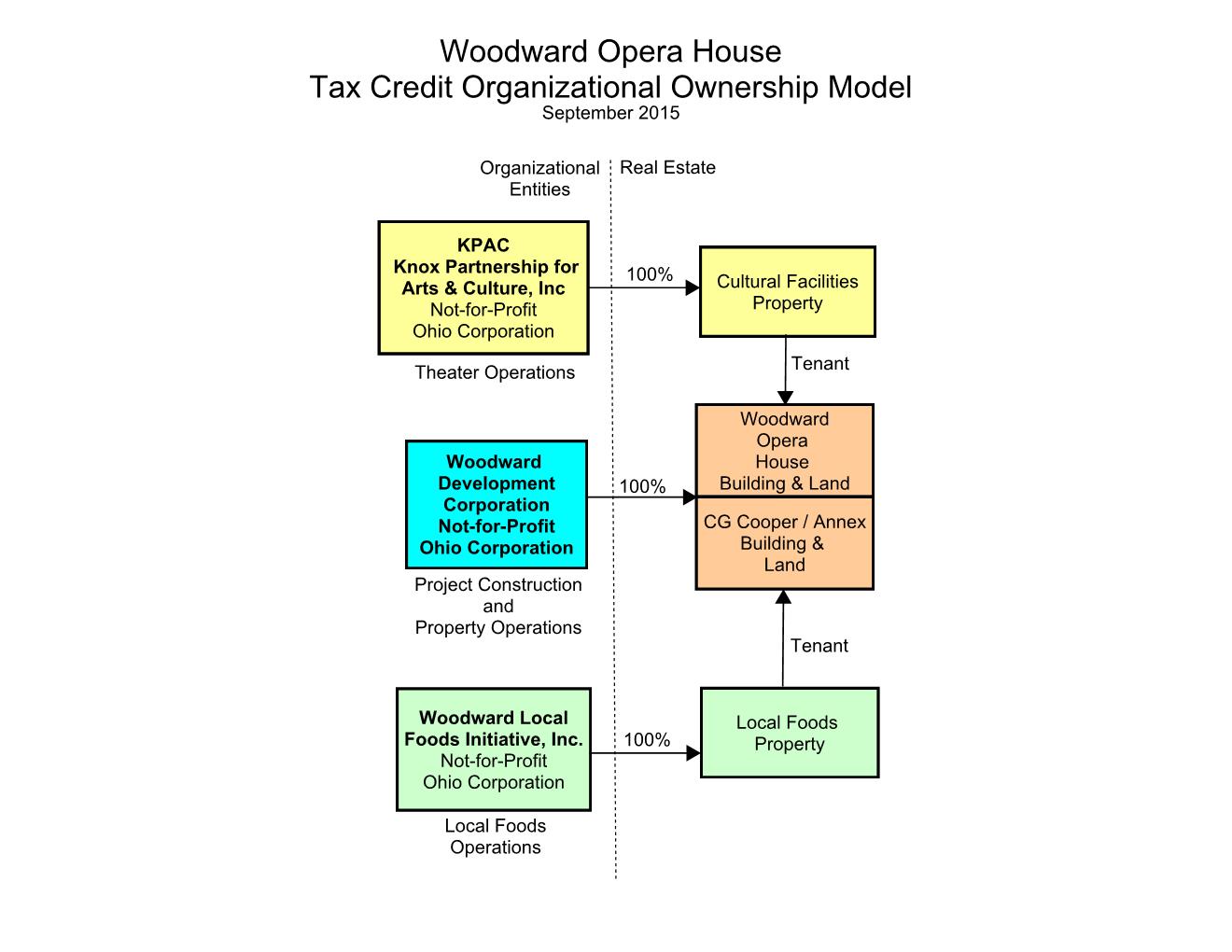

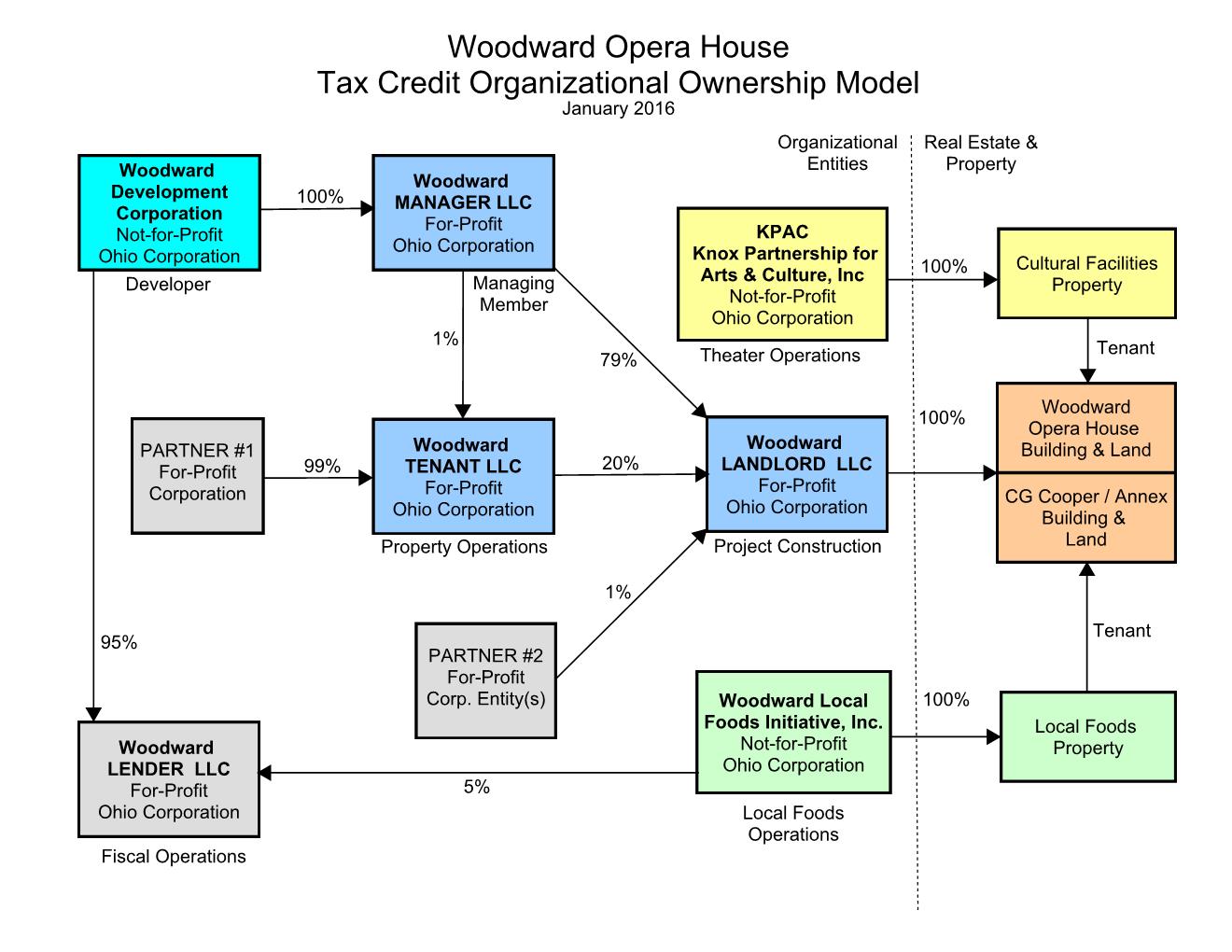

The Woodward Development Corporation (WDC) is a non-profit entity. To qualify for tax credits, WDC must partner with for-profit entities that have a “taxable income,” because you cannot receive tax credits if you do not pay taxes. The for-profit entity partners provide the WDC with a majority of the credit in the form of a grant. These are the funds that will ultimately pay for the Woodward Opera House complex’s completion.

Just how much money will the Woodward restoration project receive as a result of these historic tax credits? WDC will net over $10 million that will be directly applied to the Woodward building’s restoration.

The IRS requires a specific organizational structure. This new structure has impacted, and will continue to impact, the Woodward restoration project for at least seven years. At the end of the tax credit period, the for-profit partners will dismantle, and the non-profit WDC will once again become sole owner of the Woodward Opera House complex and any future projects.

The two charts below provide a visual of how the WDC was organized before the tax credits, and how it will be organized for the next seven years because of the historic tax credits. After seven years, the organization of the WDC will go back to the original ownership model.